Canadian initial public offering (IPO) activity boomed from 2018 to 2021, with transaction volumes peaking in 2021. A sizeable number of these IPOs were from technology-based companies that benefited from high valuations during the pandemic. By contrast, the last two years have been challenging for capital markets generally. This has especially been the case for many issuers that went public during the 2018-2021 period. A substantial number of these issuers are trading well below their IPO prices, making them potentially attractive targets to be taken private. Several issuers have already undergone such transactions. Others have announced strategic review processes, which often lead to sale or going private transactions. With significant share price declines, there is certainly a case for a number of new or recent public companies to consider a going private transaction. Doing so will require the board’s due consideration of a variety of important matters, including, in particular, overseeing conflicts of interest.

The rise and fall of the IPO market

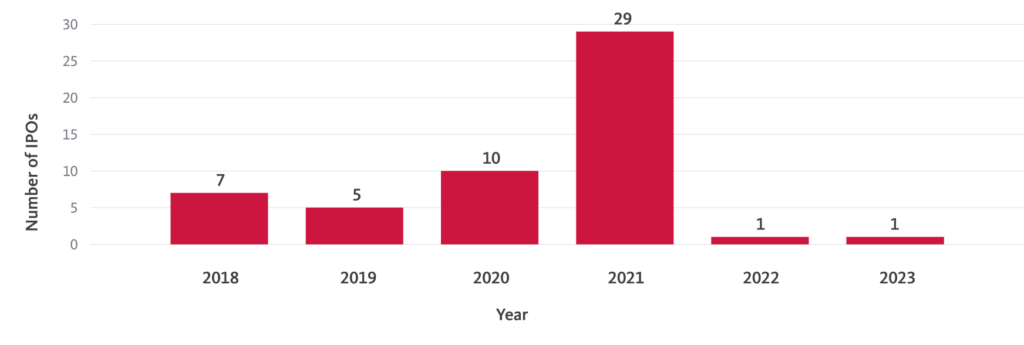

As illustrated below, following years of limited IPO activity, there was a dramatic increase in Canadian IPOs by medium- and large-cap issuers from 2018 to 2021:

Note: Data drawn from FP Advisor, limited to Canadian initial public offerings resulting in gross proceeds in excess of C$50 million, excluding reverse takeovers, special purpose acquisition companies and cross-border dual listings.

Performance of issuers that went public during this period has been mixed at best. Of the 53 IPOs completed, the share price of a majority of the issuers has declined when compared to their IPO price. Of the 45 issuers that still remain listed as of the date of this article, 20 experienced a decrease in their share price of more than 50%. Thirteen experienced no growth or realized a decrease in their share price between 1% and 50%. Only 12 of these issuers have experienced an increase in their share price.

The average share price performance for these issuers from their IPO through to November 16, 2023 has been a decline of 25%, with a median decline of 37%. Issuers that went public in 2021 have suffered more significant declines, with the share price performance from IPO to November 16, 2023 showing a 40% average decline and a 41% median decline.

Going private transactions

Of the 53 issuers that completed an IPO during the 2018-2021 period, a substantial number have completed or are completing strategic reviews and re-privatizations. Eleven of these issuers, representing 21% of the companies that went public during this window, have already gone private, are currently in the process of being taken private or have been approached with a public take-private proposal. Five issuers, representing 9% of the sample, have undertaken publicly-disclosed strategic reviews. Of those companies that have either gone private or may be considering such a transaction, only two had experienced an increase in their share price since their IPO.

Of the 53 issuers that completed an IPO during the 2018-2021 period, at least 15, representing more than 28%, have completed or are completing strategic reviews and re-privatizations.

The remaining issuers that went public during the IPO boom and subsequently went private or announced strategic reviews had experienced an average share price decline of more than 60%. Such significantly reduced share prices present attractive valuations for buyers and prospective buyers.

| Company (IPO Year) | Event | Announcement Date |

| Sundial Growers Inc. (2019) | Strategic Review | 8/13/2020 |

| dentalcorp Holdings Ltd. (2021) | Strategic Review | 11/21/2022 |

| Loop Energy Inc. (2021) | Strategic Review | 3/30/2023 |

| MAV Beauty Brands Inc. (2018) | Strategic Review | 3/31/2023 |

| Anaergia Inc. (2021) | Strategic Review | 7/19/2023 |

| AltaGas Canada Inc. (2018) | Take-Private | 10/21/2019 |

| IPL Plastics Inc. (2018) | Take-Private | 7/29/2020 |

| MindBeacon Holdings Inc. (2020) | Take-Private | 11/14/2021 |

| Magnet Forensics Inc. (2021) | Take-Private | 1/20/2023 |

| Dialogue Health Technologies Inc. (2021) | Take-Private | 7/26/2023 |

| ABC Technologies Holdings Inc. (2021) | Take-Private | 9/5/2023 |

| Neighbourly Pharmacy Inc. (2021) | Take-Private | 10/3/2023 |

| BBTV Holdings Inc. (2020) | Take-Private | 10/17/2023 |

| Q4 Inc. (2021) | Take-Private | 11/13/2023 |

| MAV Beauty Brands Inc. (2018) | Take-Private in connection with CCAA proceedings | 11/14/2023 |

| Farmers Edge Inc. (2021) | Take-Private (proposal) | 11/16/2023 |

Strategic considerations in going private transactions

When receiving a credible take-private proposal that is at a premium to the current share price but well below the issuer’s IPO price, directors are faced with a difficult decision. Should they engage in discussions about a potential sale or reject the proposal on the basis it is opportunistic? Arguably, the central consideration for the directors is assessing, on a risk-adjusted basis and with the assistance of external financial advice, the value of the proposal as compared to the value of the issuer if it were to execute on its standalone strategy – which may now be considerably lower than at the time of the IPO.

Another relevant consideration is the extent to which the shareholder base has “turned over” since the IPO (i.e., how many IPO investors remain shareholders, having not sold their shares in the interim). A shareholder’s cost basis will often inform their subsequent expectations. If a majority of the company’s shareholder base has recently acquired their shares while the issuer experienced a depressed share price, they may be more inclined to support a proposal that offers immediate liquidity at a premium to the price at which they bought their shares.

Frequently, going private transaction proposals are made by insiders of the company, such as senior management or controlling shareholders who may, with the aid of a financial sponsor, propose to take the company private. These transactions raise particularly challenging board dynamics and legal issues. A target board will need to be mindful of the conflict of interests and potential informational advantages that any insider may possess when compared to “minority” shareholders.

One relatively common feature of IPOs from the 2018-2021 period was the use of dual class share structures. These structures typically provide two classes of voting common equity securities. Commonly, founders and early sponsors would hold multiple voting shares, and sometimes even a controlling interest, while public shareholders would invest in subordinate voting shares with lesser voting entitlements. Dual class share structures raise important process design questions in the context of a take-private transaction. For example, the holders of the multiple voting shares will have considerable influence over the outcome of the transaction and may have interests that differ from the broader public shareholder base. Indeed, several of the re-privatizations that have already occurred have involved founders or significant shareholders rolling their equity into the go-forward private company.

In Canada, going private transactions that involve differential treatment of an insider are subject to enhanced procedural protections that are designed to protect the interests of minority shareholders. These procedural protections are codified and set out in Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (MI 61-101). MI 61-101 is intended to ensure all security holders are treated in a manner that is fair and perceived to be fair where the interests of related parties differ materially from the interests of minority shareholders. This can address a variety of conflict considerations, including rolled equity valuations and employment entitlements such as equity compensation and change of control payments.

While the procedural protections applicable to a particular going private transaction will depend on its structure and the availability of any exemptions, they typically include the need to obtain a formal valuation from an independent financial advisor, enhanced disclosure requirements and a requirement to obtain approval of a majority of minority security holders. In addition, the formation of a special committee of independent directors empowered with a robust mandate and independent advisors is typically a critical component of the target company board’s process when considering such transactions.

A well designed, robust process is critical to the successful execution of any going private transaction, and in particular, where insiders are involved. Staff at various provincial Canadian securities regulatory bodies actively monitor and review material conflict of interest transactions on a real-time basis for compliance purposes and with a view to identifying and addressing public interest concerns. In order to avoid transaction execution risk and delay, boards of directors need to adopt rigorous processes and ensure that the issuer’s disclosure can withstand heightened regulatory scrutiny.

Conclusion

As a majority of companies that went public between 2018 and 2021 continue to trade well below their IPO prices, we expect there will be additional strategic reviews and take-private transactions involving these issuers in 2024. These processes and transactions attract significant market attention and can also attract regulatory scrutiny. Issuers and their boards of directors need to have careful regard to the complex requirements under corporate and securities laws that are specifically designed to provide protection to minority shareholders in such going private and related party transaction situations.